I was going to wait to write this newsletter…

… but with the recent collapse of SVB (and bailout), it feels like the right time.

Money, finances & loopholes have always captivated me.

Not because of wealth creation & accumulation.

Because I realized very young there is always a game being played in which most don’t know the rules.

The ones who do are operating in opposition to the other 99%.

In truth, money is fake.

A series of numbers within a database that we agree holds value.

If that agreement ceased to exist, so would monetary policy as we know it.

Fun Fact - Only 4% of the 'money' in the world exists in cash. The US dollar has not been backed by gold since President Nixon 'nixed' it in 1971. *I do not know if that's where 'nixed' came from... lol.

I’ve never been afraid of debt, but I did rack up more consumer (bad) debt in my early 20’s than I care to admit.

The blessing was that in a synchronistic turn of events, it opened my eyes to the leverage game.

Then the world went dark in 2020… and so did I.

My insatiable focus became myself, my health, and my education.

I started reading/listening to 3-5 books per week.

I enrolled in Tony Robbins Platinum Partnership.

I was taking online courses like they were going out of style.

From the moment I woke up to the moment I went to sleep I had headphones in.

*Which also led to the end of my relationship… but that’s a story for another time.

The hours I put in that year rewired how I now think…

… and altered my perception of the limitlessness of our existence.

Then I discovered Infinite Banking… and my beliefs turned upside down.

</the psychology>

The Psychology of Money and Business Psychology are fascinating things.

Most people save to spend, invest to retire, and use debt to buy what they don’t need.

What if instead we viewed saving and investing as a way to reach financial independence.

This is the state where work becomes optional… passive/active investments become greater than your liabilities.

*Meaning you get paid more in passive income than you spend each month.

It never made sense to me to work for 40 years just to stop working…

I understand the emotional nature of spending on things we don’t need to impress people we don’t like (thanks Will)... as I’ve been guilty of that in the past.

The real kicker came when I looked at how banks viewed a balance sheet.

We’re taught to view cash as an asset, and debt as a liability.

Banks view cash as a liability, and debt as an asset.

Why?

Because debt is where money gets made.

If I loan you $100k at a 10% annual interest rate… I create $10k from nothing.

Better yet… banks can loan out at a rate 10x of what they have.

So say they want to give someone a $1M loan, they only need to have $100k.

Let’s go one step deeper.

What if there was a way to put your money into an account that…

- Earned tax-free growth

- Allowed you to be your own bank

- Would let you take out loans for yourself (without affecting the principle)

- Offers your beneficiary a guaranteed death benefit.

Now, this is where those with a closed mind will fight back.

It contradicts the identity they have surrounding who they are in relation to the money they ‘have’.

The problem most face is they *believe what they ‘know’ to be true.

Yet it’s those beliefs that prevent them from installing new empowering ones.

Take a breath and challenge yourself to view this from a different perspective.

*This is something we address in depth on my Align Your Purpose retreats.

Truth of the matter is this:

- Savings accounts lose money every year due to inflation.

- Credit is not the devil… but a creator of expanded opportunity.

- Rainy day funds orient your subconscious to look for problems.

- The absence of debt limits your ability to use compounding leverage.

These ‘rules’ were created by people who benefit from you not knowing…

… not knowing how to play the game, or that there is even a game in the first place.

It’s the same reason infinite banking policies are not discussed…

… yet the top 5 holders of policies in the world are the top 5 banks.

Coincidence?

Take a step back and start to follow the money and you’ll see the world differently.

The ultra-wealthy pay less in tax, not because they’re cheating the system, but because they’re using it as it was designed.

Good news is you don’t have to be the next Buffett to benefit… you need to educate yourself on the policies available to you.

</the system>

So… how does it work?

There are a few different styles of life insurance policies you can do this with.

Let’s look at the two most popular… both are permanent insurance.

Permanent Insurance - A contract with a life insurance company to protect the policyholder for the entirety of their life.

As an aside, for this to work you must work with someone who knows how to properly structure overfunded permanent life insurance. It must be customized to what you can afford and structured so it does not become a Modified Endowment Contract (MEC).

Whole Life - Cash value grows based on a fixed interest rate.

Indexed Universal Life - Cash value grows based on an index’s (stock) performance.

Here’s the high level understanding of how it works…

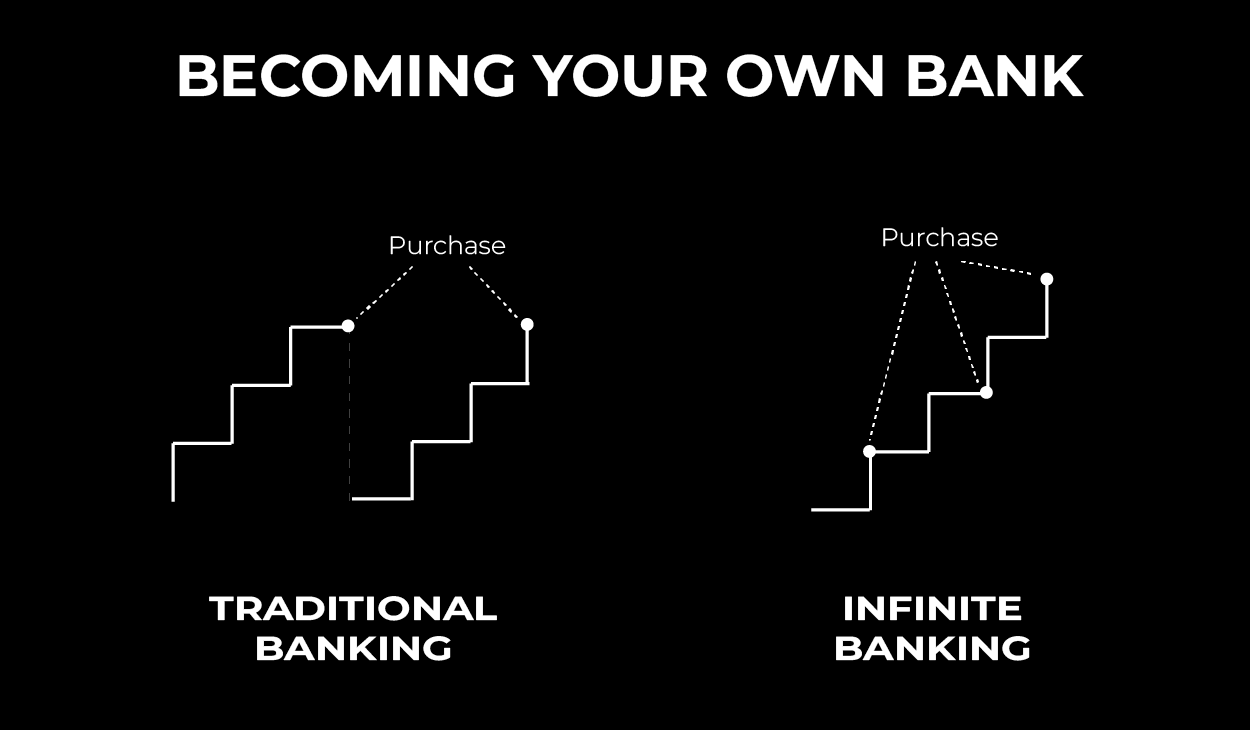

Say you save $100k to buy a $100k boat.

When you buy that boat your savings account goes to $0 and you now have a boat.

If instead you invested that $100k into a properly structured policy, you could loan yourself $100k to buy the boat.

Your principle remains in the policy and acts as collateral if you default…

... and you’d begin paying your own policy back with interest - just as you would a bank.

Best part… Most policies have fixed loan interest rates that blow market rates out of the water.

For example, the interest rate on my policy is 2.75%.

Repeat this cycle and watch as you cashflow your own investments, grow a cash account tax-free, and have a guaranteed payout for yourself + death benefit for your beneficiary.

</the technology>

I have to add in here that this post is NOT financial advice.

This is a product I use myself and believe in…

... and is something I’ve helped setup for some of my more growth-minded clients.

If this is your first introduction to Infinite Banking, do your own research.

To start, read the following:

Heads I Win, Tails You Lose by Patrick H. Donohoe

Becoming Your Own Bank by R. Nelson Nash

The Power of Zero by David McKnight

I end these with a ‘How To’ section, but because of the uniqueness…

If you want me to point you in the right direction for you, just send me an email.

Good luck with your research… Its rabbit season.

Inputs Only – Newsletter

A weekly email of learnings for life & work.

.png?width=588&height=164&name=Kevin%20Wathey%20-%20Signature%20%5BTransparent%5D%20(No%20SubTitle).png)